Branded Residence Models

Successful branded residence projects depend on early strategic alignment between the developer, the chosen brand, and the needs of the target market. Pre-design considerations are critical, especially in defining the project’s positioning, whether lifestyle-oriented or ultra-luxury. Developers should identify the target market early and engage the brand at the outset to ensure that the product mix, layouts, and amenities align with brand expectations.

In parallel, a detailed market study is often required to benchmark pricing, unit typologies, and competing developments, particularly in emerging markets where the brand’s due diligence threshold is higher. Input from residential sales agents is equally vital in this phase to assess sales velocity and price premiums, especially given the likely uplift in HOA fees tied to branded services and facilities.

Design development must also accommodate brand-specific operational and amenity requirements, which differ from standard residential or even luxury condo projects. Brands often require enhanced back-of-house areas, staff and service corridors, upgraded security protocols, and specific layouts to support their service delivery standards. These elements can impact both costs and net saleable area, so they must be accounted for early. Legal and contractual considerations also play a key role. Brands typically demand protections such as defect liability reserves and restrictions on short-term letting platforms to preserve brand integrity. Furthermore, all sales and marketing materials must receive brand approval to safeguard the brand’s equity. For developers and investors, navigating these complexities early and proactively is essential to maintaining programme efficiency, protecting margins, and achieving long-term asset value.

Since branded residences rely heavily on the brand’s reputation, investors and developers should consider including contract clauses that protect the property’s value if the brand’s image is damaged. Similar clauses are sometimes used in hotel management agreements.

Stakeholders

Developers

Branded residences are becoming a popular part of real estate development, bringing clear benefits for both developers and investors. By using the name and reputation of a well-known brand, these projects often sell faster, can be priced up to 30 percent higher than similar non-branded units, and offer extra ways to earn revenue. These advantages help increase the total value of the project.

At the heart of this appeal lies the brand itself. The choice of brand not only defines the market positioning and public image of the development but also influences key aspects such as architecture, interior design, unit mix, and pricing. A strong brand attracts loyal customers who are willing to pay a premium for the assurance of quality and service standards. However, working with a global brand also introduces constraints. Developers must typically adhere to strict design standards, engage with the brand’s technical services team, and accept limited flexibility, particularly when residences are tied to a rental or hospitality program

From a financial standpoint, branded residences offer several advantages. Units are often sold off-plan with structured payment schedules, typically beginning with a 5–10% deposit followed by milestone-based payments totalling up to 70% before handover. This improves cash flow and reduces the developer’s reliance on debt. In many markets, regulations also allow developers to use buyer deposits to fund construction, further enhancing liquidity, an especially valuable tool in high-interest or low-leverage environments.

Branded residences also serve as a strategic solution to the growing challenges in hotel financing. With traditional lenders tightening their terms (Basel III/IV) and amid global economic uncertainty, it has become increasingly difficult to

secure financing for pure hotel developments. The inclusion of branded residential components can help developers secure funding, reduce financial exposure, and bring capital back earlier through residence sales. In many cases, successful pre-sales can even improve the financing terms of the hotel component itself by boosting lender confidence.

For developers, this structure helps accelerate the repayment of construction loans and enhances overall project returns. Residential components typically deliver higher margins than hotels alone, making them an effective tool for improving the financial feasibility of five-star hospitality developments that might otherwise be cost-prohibitive. In this way, branded residences create premium returns for the entire project.

However, combining residential and hotel uses adds complexity. In resort destinations, zoning laws may require short-term rental programs, while in urban markets, buyers may prefer privacy and exclusivity over rental income potential. These dynamics require careful planning and transparent communication with prospective buyers to align expectation.

Despite these challenges, the branded residence model continues to grow globally, supported by rising demand for high-quality, lifestyle-driven real estate and a desire for services traditionally associated with luxury hotels. When executed effectively, these projects allow developers to de-risk construction, enhance returns, and create iconic developments that resonate with a global audience.

Successful pre-sales can even improve the financing terms of the hotel component itself by boosting lender confidence

Operator

For hotel operators, branded residences are both a growth strategy and a revenue generator. They provide high-margin income through branding and licensing fees, as well as recurring revenue from homeowner associations and rental program management. These projects also deepen customer engagement by extending the brand relationship beyond the hotel stay and enhancing revenue streams from F&B, spa, and retail outlets, particularly in resort locations where residences may contribute to the hotel’s inventory.

Maintaining brand consistency across all aspects: design, service, and operations is critical. Projects may be integrated with hotels or developed as standalone residential offerings, each requiring tailored legal agreements such as the Hotel Management Agreement (HMA), Technical Services Agreement (TSA), and Residential Marketing License. Operators are increasingly involved in the planning stages to ensure that infrastructure, layouts, and back-of-house provisions are designed to support long-term operational efficiency.

In resort markets, operators also play a key role in shaping the rental program strategy, as transient use is often an essential component of the project’s financial viability.

Investor / Owner

Branded residences appeal to both lifestyle buyers and investors by combining luxury living with strong return potential. For end-users, these properties offer prestige, quality design, hotel-style services, and the reassurance of a professionally managed environment. For investors, they present opportunities for capital appreciation and steady rental income, particularly in resort destinations where rental programs are often integrated.

A key attraction is the turnkey nature of these homes: they are typically delivered fully furnished and styled according to brand specifications, catering to high-net-worth individuals seeking convenience. However, this also means accepting limitations, such as restricted customization and compliance with homeowners' association (HOA) rules that protect brand integrity.

Despite their appeal, branded residences come with challenges. Management fees typically range from 2% to 3% of the property’s value. Strict brand governance can be frustrating for both owners and developers.

Despite inherent risks, branded residences often deliver attractive returns. In key global markets such as Miami and Dubai, these properties consistently outperform their non-branded counterparts. Yields typically range from 6–8%, compared to 4–5% for standard luxury residences.

For instance, in 2024, the St. Regis in Miami reported a yield of 7.2%, according to Omnia Capital Group, driven in part by the rental income generated during owner absences.

Branded residences also demonstrate stronger value retention. During the 2020 downturn, branded homes in London’s Mayfair declined by only 5%, roughly half the loss experienced by non-branded equivalents. In Dubai, Four Seasons-branded units appreciated by 20–25% upon resale.

In 2024, Dubai's branded residences market experienced significant growth, with total sales reaching approximately AED 60.1 billion (around USD 16.35 billion). This represents a 43% increase compared to 2023 in number of units.

That said, the segment is not without its vulnerabilities. Poor service standards or weak brand execution can negatively impact resale values. Moreover, branded residences are not immune to broader market shocks. During the 2008 financial crisis, branded units in Miami fell by 20%, slightly more than the 15% decline in non-branded homes.

In addition to brand association, ESG considerations are increasingly central to branded residences, reflecting growing investor and buyer expectations. Luxury developments often integrate sustainability features, such as energy-efficient designs, renewable energy sources, green certifications, and wellness-oriented amenities. These not only enhance a project's market appeal but can also positively impact long-term property values and operational efficiency, attracting environmentally and socially conscious buyers willing to pay a premium for sustainability and wellness.

Well designed residences can combine strong yields with luxury lifestyle under one roof

Pipeline & Growth Projection

The branded residence sector continues its impressive expansion, with a robust pipeline dominated by major global hospitality brands. Marriott leads the field by a considerable margin, with nearly 300 branded residential projects either completed or in development. Accor also maintains a strong presence, followed by Four Seasons, Hilton, and Hyatt. Notably, non-traditional entrants such as Elie Saab, Greg Norman and automotive and fashion brands like Tonino Lamborghini and Giorgio Armani are making significant growth, reflecting the sector's diversification and increasing appeal beyond pure hospitality operators. This trend not only broadens consumer appeal but also allows developers to differentiate their offerings in saturated markets: a great example of this, is Chelsea FC Branded Residences with over 1,400 apartments developed by Damac that was sold out in 1,5 hours

On a global scale, the sector has experienced an extraordinary trajectory, with the number of branded residence projects expected to rise sharply through the early 2030s, peaking at over 3,750 projects by 2036. While the year-on-year growth rate is projected to gradually taper off from its mid-2010s peak of around 17%, the sustained expansion in absolute terms emphasises a structural evolution in residential real estate. This long-term growth is driven by rising global wealth, consumer demand for branded lifestyles, and the increasing alignment between real estate and brand equity. For investors, developers, and brands alike, the sector offers a compelling intersection of luxury, resilience, and global scalability.

80% of the global branded residences are managed by hotels- Graham Associates

Demand

The ultra-high-net-worth individual (UHNWI) population is expected to grow by over 28% between 2023 and 2028, led by North America and fast-expanding regions like Asia. This surge in global wealth is fuelling demand for luxury hospitality and branded real estate, as UHNWIs increasingly seek not just unique experiences but also lifestyle-aligned investments.

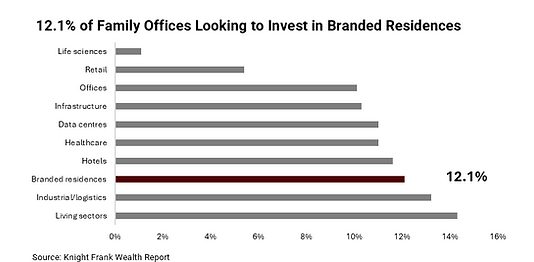

Luxury leisure hospitality is forecast to grow at a 10% CAGR during this period, with spending rising across all wealth tiers; from very high-net-worth individuals to aspiring luxury segments. In particular, branded residences are gaining traction as they offer UHNWIs the dual benefits of luxury living and strong brand affiliation. More than 12% of global family offices are now looking to invest in branded residences, highlighting the segment's growing appeal among the world’s wealthiest individuals.

Globally, the number of millionaires is set to rise significantly. The U.S. will grow from 21.9M to 25.4M, with strong gains in Mexico (24%), Canada (21%), Sweden (22%), Norway (27%), and Switzerland (16%). Asia stands out, with Taiwan, Turkey, and Kazakhstan all projected to grow above 40%, while China adds 500,000 millionaires. Australia will see a 21% rise, and emerging regions like Africa and South America show promising trends, underscoring global momentum in wealth accumulation.

While the Middle East continues to thrive as a hub for luxury hotels and branded residences, investors should not overlook emerging opportunities in other regions such as Asia-Pacific.

Premium

Across the world, branded residences consistently command a notable premium over non-branded luxury properties, driven by a combination of global brand equity, curated services, and strong buyer perception of long-term value. The premiums typically range from 20% to 35% and can reach as high as 45% in high-demand or limited-supply locations. For instance, Hilton-branded residences average a 24% price uplift compared to similar non-branded units, while resort-based branded products have seen premiums of up to 34%. These figures highlight the market’s willingness to pay for the assurance, lifestyle, and status that comes with a branded offering, particularly in competitive or international gateway cities.

Average ticket sizes further illustrate this pricing power, with branded residences in New York commanding the highest price among surveyed markets at over USD 7.2 million for a two-bedroom unit. London follows at USD 4.74 million, with premium pricing also evident in markets such as Miami (USD 2.4 million), Athens, and Dubai. At the other end of the spectrum, emerging destinations like Sichon and Phuket still achieve healthy ticket sizes: USD 936k and USD 1.26 million respectively; indicating that even in non-traditional luxury hubs, brand association adds measurable value. While higher HOA fees and operational costs must be considered, the premium pricing, coupled with strong resale potential and alignment with affluent buyer demand, positions branded residences as a compelling long-term investment strategy.

Dubai – Unrivalled Branded Residence Hotspot

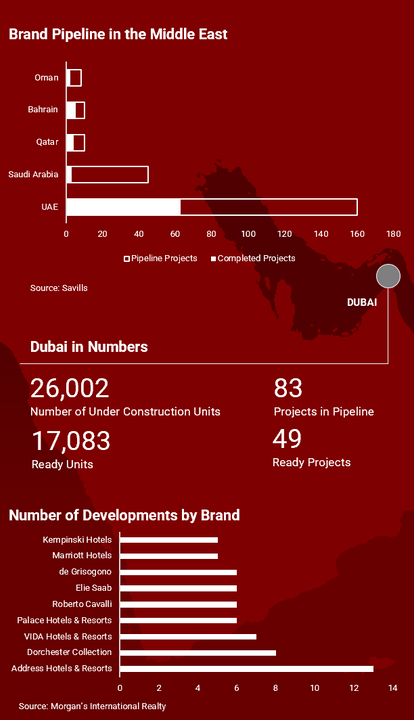

Dubai has become a leading global hub for branded residences, thanks to strong investor interest and available capital. The large number of ongoing projects, and high price premiums over non-branded homes are appealing for developers, brands and investors. The city currently has 26,000 branded units under construction and 17,080 already completed, with 83 projects in the pipeline and 49 delivered.

In some areas like Jumeirah Beach Residence and Palm Jumeirah, selected branded residences are priced more than 90% higher than unbranded ones. Major global brands such as Address, Dorchester Collection, and Ritz-Carlton are active in the market, with Address Hotels & Resorts having the most developments.

The UAE is also the regional leader in branded residence growth, well ahead of Saudi Arabia and Qatar. This shows Dubai’s strong position as a top choice for wealthy buyers looking for luxury homes that offer both lifestyle benefits and investment value. Unlike many other major markets where nearly half of branded home sales go to international buyers, Dubai’s market is mostly driven by local buyers, setting it apart from other global cities.