Global Tourism Outlook

The European hotel market is expected for continued growth in 2025, with international tourism expected to rise by 3–4% (earlier forecasts had been more optimistic), driven especially by increasing demand from the Asia-Pacific region. In contrast, U.S. hotel performance is expected to be hindered by noticeably lower inbound travel performance. While the rapid post-pandemic recovery observed in 2023 and 2024 is beginning to level off globally, industry sentiment remains optimistic.

According to the UN Tourism Confidence Index, 64% of experts anticipate improved conditions. However, economic uncertainties, including inflation, high travel costs, and staffing shortages continue to present challenges. Additionally, rising geopolitical tensions, tariffs, and the risk of trade wars may hinder growth by dampening global economic activity and complicating international travel. As a result, Fitch Ratings has maintained a neutral sector outlook. Hotel performance across Europe is expected to remain strong, although slightly softer than in 2024, partly due to a reduction in large-scale events driving demand

Hotel Revenue Outpaces GDP Growth

A close look at the global hotel industry's revenue growth versus global GDP from 1999 to 2024 reveals a compelling narrative of resilience and long-term outperformance. The graph highlights how hotel revenues have consistently outpaced GDP, despite sharp downturns during major crises like the 2008 financial collapse and the COVID-19 pandemic in 2020. While GDP followed a steady upward trend, hotel revenues showed greater volatility, but also a much stronger rebound. By 2024, hotel revenue had surged to nearly 300% of its 1999 level, far surpassing global GDP growth, which reached around 200%. This trajectory demonstrates not only the cyclical sensitivity of the sector but its remarkable capacity for recovery, driven by the rebound in global travel and evolving consumer preferences toward experiences.

These patterns have made hotel real estate increasingly attractive to a broadening base of investors. What was once viewed as a niche or opportunistic asset class is now becoming a core component in institutional portfolios. The sector offers both income and growth potential, supported by strong fundamentals, professionalised operations, and the global expansion of branded operators. Investors are drawn to the hotel industry's proven ability to weather economic turbulence and emerge stronger, making it a strategic asset for diversification and long-term value creation. With travel demand rising and hotel performance consistently outstripping macroeconomic indicators, hotels are securing their place as a central pillar in global real estate investment strategies.

Global Room Supply and RevPAR Growth

The steady rise in global hotel industry performance is clearly reflected in both RevPAR and room supply data. According to STR, global RevPAR surged from $73.78 in 2019 to $90.44 in 2024, showing not only a full recovery from the COVID-19 low of $34.18 in 2020 but also significant growth beyond pre-pandemic levels. This recovery illustrates strong accommodation demand and robust pricing power across markets. At the same time, global room supply has continued its upward trajectory, from 19.5 million rooms in 2019 to 22.6 million in 2024 signalling growing investor confidence and the ongoing attractiveness of the hotel sector. The simultaneous rise in both demand and supply highlights the sector’s resilience and reinforces its appeal as a core component of real estate investment portfolios.

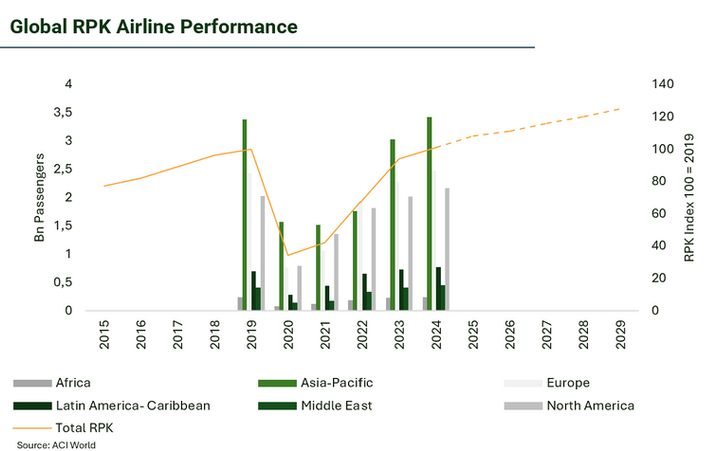

The aviation industry in 2025 will continue facing capacity constraints due to ongoing MRO issues and aircraft production delays, limiting growth to 3-4%. Corporate travel demand will recover gradually, stabilizing global load factors, while airfares are unlikely to drop significantly despite lower oil prices, due to supply shortages: aircraft deliveries in 2024 experienced a shortfall of 575 planes, representing approximately 30% of the planned deliveries and rising operational costs. Meanwhile, some governments may reconsider strict sustainability regulations due to economic impacts, balancing environmental goals with industry growth. Taking everything under consideration, the global passenger traffic is set to surpass pre-pandemic levels in 2024 (9.5Bn), exceed 12Bn by 2030, and double to 19.5Bn by 2042.

Hotel Development Costs Across EME

Hotel development costs across the EME region show considerable variation, shaped by local market dynamics, construction standards, and regulatory environments. The United Kingdom and the Nordic countries stand out as some of the most expensive locations for new hotel builds. In the Middle East, Saudi Arabia is projected to be the costliest market for hotel development.

While construction costs have only seen a modest increase overall, the real challenge in getting projects off the ground lies in the financial landscape. Post-pandemic market conditions have brought higher debt interest rates, stricter LTV ratios, and elevated yield expectations from investors, all of which have made it harder to underwrite viable development cases. However, the sentiment is beginning to shift. A growing number of developers, investors, and operators are no longer waiting for a return to pre-2020 conditions. Instead, they are adapting to the current financial realities and moving forward with projects that align with today’s investment metrics. This acceptance marks a significant turning point, suggesting that despite the headwinds, development pipelines may begin to pick up pace once again.

Hotel Development Cost per Segment in Different Countries

Investor Appetite

The European hotel investment landscape is undergoing a noticeable shift in financing strategies as stakeholders adjust to evolving macroeconomic conditions. Private equity remains the most prominent source of equity financing, with 36% of market participants expecting it to be the primary capital source by 2025, up from 31% in 2023. Real estate funds and REITs are also expected to play a meaningful role (15%), while interest in sovereign wealth funds and dedicated hotel investment vehicles appears to be waning. This trend emphasises a more cautious and selective approach among institutional investors and family offices when it comes to capital deployment.

On the debt side, traditional financing is making a comeback. Over half of respondents (54%) anticipate it will be the leading funding source for hotel acquisitions in 2025. Senior bank loans, previously subdued amid heightened interest rates are projected to regain traction, with 37% citing them as a key source of capital. In contrast, the reliance on alternative lenders, which surged in recent years, is beginning to decline, with investor preference dropping from 55% in 2024 to 43% in 2025.* This indicates a gradual return to conventional lending structures, supported by improving debt costs as interest rate cuts begin to take effect.

The Middle East’s Investment in Tourism is Expected to help EME Maintain its Leading Position in Cross-Border Hotel Investments.

The EME region continues to lead globally in cross-border real estate investment, consistently attracting the highest share of inbound capital. In key years such as 2019 and 2021, EME drew USD 6 billion and USD 5.5 billion respectively, and in 2024 it rebounded to USD 4.6 billion, significantly ahead of the Americas and APAC.* This sustained interest highlights the region’s appeal, rooted in economic stability, strong market fundamentals, and a wealth of institutional-grade assets. However, making the investor landscape more prone to political disturbances.

Among the standout stories within EME is Saudi Arabia, which has rapidly positioned itself as one of the most ambitious destinations for tourism-related investment. Under its Vision 2030 programme and the National Tourism Strategy, Saudi Arabia is aiming to attract 100 million tourists annually and make tourism a key contributor to GDP.

At the IHIF EME 2025 conference in Berlin, officials announced an USD 80 billion opportunity still available for international investors across hospitality and retail, supported by incentives such as capex subsidies, reduced government fees, and regulatory reforms ensuring equal treatment for foreign and domestic investors. Already, global hotel brands like Hilton, IHG, and Accor are increasing their presence, and major projects like the Red Sea development are progressing rapidly. With a combination of visionary planning and investor-friendly policies, Saudi Arabia is emerging as a central force in EME’s growing dominance in global tourism investment.

Yields and Operational Models

Hotel Investment Yields & Trends in Europe

Hotel yields have traditionally been higher than those of other core real estate sectors, offering a compelling return profile that has attracted a diverse investor base ranging from institutional investors to high-net-worth individuals. Over the past few years, hotels have become an increasingly important allocation in real estate portfolios, driven by their higher yields, operational flexibility, and inflation resilience.

Hotel yields remain elevated compared to logistics, and retail. According to recent data, yields across Europe and the UK saw a notable spike during 2022–2023 but have since started to stabilise. However, they remain above pre-pandemic levels, and a full return to those historic lows is unlikely in the near term due to ongoing political and macroeconomic uncertainty.

Despite recent volatility, yields are expected to gradually level out as market fundamentals strengthen. Hotel assets continue to offer attractive risk-adjusted returns, particularly in markets where tourism and business travel have recovered robustly.

Geographic and Segment-Based Yield Variance

Yield levels vary significantly across geographies and hotel classes. Eastern European markets continue to offer the highest yields, with budget and midscale hotels in non-core cities reaching up to 9.5%. Western European gateway cities remain competitive but offer lower yields. For example, yields in France’s Gateway Cities range from 6.5% (Budget) to 4.9% (Luxury).

Lease and Management Contract Yield Adjustments

The contractual structure also impacts yields. Properties under lease agreements typically offer lower operational risk but also lower upside potential. Lease-adjusted yields may be 0.5% to 0.7% lower than average yields. Conversely, management contracts, particularly those with performance-based incentives that can add up to 0.2-0.4% to the yield. Additionally, the annual cash flow return can be higher.

Historically, risk-averse investors have favoured fixed leases. However, operators are increasingly shifting toward asset-light strategies due to the benefits to their balance sheets and stock valuations. Even in Central Europe and the Nordics which have traditionally been strong lease markets, though management contracts and hybrid models are becoming more prevalent. This is particularly true for upscale and lifestyle brands, which thrive on flexible cost structures and strong brand alignment. A well-defined concept and a capable manager can create more long-term value and cash flow for investors than traditional lease models, especially when value creation through operational optimisation through incentives, larger variety of operators and brands is factored in.

LTV Ratios Across Europe

Loan-to-value ratios are a central consideration in hotel real estate development, reflecting lenders’ risk appetite and shaping developers’ access to capital. Across Europe, senior LTV levels for hotels typically range from 45% to 65%, with countries like Poland and Spain reaching the higher end, while more conservative markets such as Belgium, France, and the UK remain around 45–55%. LTV trends are mostly stable, though slight upward movement is observed in select countries like Denmark and Spain, signalling cautious optimism from lenders. Higher LTV allowances can ease equity requirements for developers but also come with greater scrutiny of project fundamentals such as location, brand strength, operator quality, and ESG compliance all play a role in lender decision-making.

As traditional banks tighten underwriting standards, developers may face stricter caps on LTV, with banks often limiting loans to 75% or less of asset value and requiring more equity for riskier profiles. Amid this evolving landscape, green financing is emerging as a powerful tool to help developers improve their financing terms and potentially unlock higher LTVs. Investors and lenders are increasingly rewarding sustainable hotel developments, those that are meeting environmental standards or committing to carbon reduction with favourable debt margins or access to green bonds.

ESG-aligned projects not only appeal to institutional capital but also mitigate long-term operational and regulatory risks, making them more bankable. Leading hotel companies like Marriott International have integrated sustainability into their development frameworks, while ESG metrics are now often embedded in hotel management agreements to ensure operator accountability. In a capital-constrained market, sustainability-linked financing offers a strategic advantage: by enhancing a project’s ESG profile, developers can strengthen their case for higher leverage, reduced borrowing costs, and broader investor appeal, an all critical as the sector adapts to heightened interest rates and regulatory change.

"When we talk to our owners and franchisees, it's not interest rates or construction costs.” – “It's the availability of debt for new construction. We have hundreds of shovel-ready projects, and they're stalled not because of interest rates or a little elevated construction costs; it's just that capital for new construction is still restricted.“

Anthony Capuano, president and CEO of Marriott International at the Americas Lodging Investment Summit in Los Angeles – January 2025

Demand

In 2024, global RevPAR increased by 15% compared to 2019, driven largely by exceptionally high ADRs and major global events such as Taylor Swift’s Eras Tour. While such large-scale events are less likely to occur in 2025, hotel operators remain optimistic about stable performance, underpinned by resilient consumer spending and sustained leisure travel demand.

RevPAR growth is projected to continue into 2025, albeit at a more moderate pace as the post-pandemic recovery begins to stabilise. Core urban markets such as Paris, Madrid, Rome, and Milan are expected to remain top performers. The UK hotel sector may benefit from increased international visitation, supported by a weaker pound, despite facing slower domestic economic momentum.

Hotel stays across Europe are projected to rise, with Spain, Italy, and Germany maintaining leadership in total visitor numbers. Meanwhile, Nordic countries, particularly Sweden, Norway, and Finland are poised for above-average growth, with anticipated CAGR rates of 5–6% driven by high demand for Lapland, coolcation and trendy cities such as Copenhagen, Helsinki and Stockholm. However, geopolitical uncertainties and potential supply constraints in select markets may present operational challenges.

Despite these risks, strong underlying demand and adaptive pricing strategies are expected to support the resilience of the European hospitality sector throughout 2025. Nonetheless, ongoing geopolitical tensions and delays in the delivery of new aircraft may act as headwinds, even as consumers increasingly prioritise spending on travel, dining, and experiences.

Supply in the EME

The hotel market across EME is projected to continue expanding in 2025, albeit with notable regional contrasts in pace, investment strategies, and development focus. While the European pipeline remains active yet constrained by economic headwinds, the Middle East continues to exhibit strong momentum, buoyed by long-term tourism visions and significant government-backed funding.

The European hotel market is poised for continued growth in 2025, supported by resilient demand fundamentals. However, high interest rates, rising construction costs, and stricter financing conditions are slowing the pace of new supply. As of early 2025, the European pipeline includes 1,661 hotels and 244,464 rooms in various development stages:

Urban markets such as Brussels, Dublin, and Warsaw are expected to lead growth, with projected supply increases of 6–10% over 2023 levels. Yet overall development activity remains uneven, particularly in Central Europe, where lease-based models are being challenged by fixed rental obligations and reduced profitability.

To mitigate capital risks, operators are shifting toward asset-light strategies including management agreements, joint ventures, and sale-leasebacks. At the same time, investors are focusing on value-add strategies, particularly conversions and adaptive reuse projects. Office-to-hotel transformations are gaining momentum, especially in dense urban areas with limited new-build opportunities.

Additionally, ESG considerations are now central to investment decisions. Sustainability-linked financing, carbon-neutral developments, and energy-efficient refurbishments are aligning with EU climate goals and enhancing asset appeal to institutional investors.

In contrast to Europe’s cautious pipeline, the Middle East continues to experience rapid and large-scale hotel development, fuelled by government-led tourism and diversification strategies. The regional pipeline includes 619 hotels and 155,428 rooms, with significant near-term delivery:

Luxury remains a central focus in the Middle East development strategy, with 179 luxury hotels (41,508 rooms) underway, a substantially higher than Europe’s 127 hotels and 16,786 rooms in the same category. Premium segments (upscale and upper-upscale) also account for a sizable portion of the Middle East’s pipeline, reflecting strategic positioning ahead of global events and rising regional tourism.

Key growth markets include Saudi Arabia, the UAE, and Qatar, where national programs such as Saudi Vision 2030 and Dubai’s post-Expo transformation are accelerating infrastructure and hospitality investment. These initiatives benefit from strong sovereign backing, insulating them from broader financing challenges.

Saudi Arabia is targeting $80 billion in international investment for tourism, with incentives including subsidies of up to 25% of capex in priority areas, a 75% reduction in government fees, and new regulations ensuring equal treatment for foreign investors, highlighting tourism as a core pillar of its Vision 2030 strategy.

How EU Sustainability Reforms Are Reshaping Hotel Development Across EME

The European Union’s sweeping reforms to sustainable finance policy, particularly the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), the EU Taxonomy, and the Omnibus Directive, are making waves across the hotel industry in Europe, the Middle East, and Africa (EME). While these reforms are rooted in EU policy, their influence is increasingly felt beyond the area’s borders, affecting how hotels are financed, developed, and operated.

These regulatory shifts are driving a new standard of ESG performance. Hotel developers, operators, and investors are expected in near future to navigate a landscape where disclosing ESG data, aligning with sustainable building criteria, and managing ethical supply chains are no longer optional but essential for competitiveness.

One of the most consequential developments is the CSRD, which requires large companies to report ESG data using standardized metrics. Hotel groups with more than 1,000 employees must now disclose their energy usage, emissions, diversity figures, and more. Even mid-sized players are choosing to comply voluntarily to meet the expectations of banks and investors. Meanwhile, the CSDDD holds companies legally responsible for identifying and mitigating human rights and environmental risks across their value chains, from construction contractors to suppliers of hotel amenities. For hotel groups, this means establishing robust due diligence systems and rethinking procurement strategies.

How EU Sustainability Reforms Are Reshaping Hotel Development Across EME

The European Union’s sweeping reforms to sustainable finance policy, particularly the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), the EU Taxonomy, and the Omnibus Directive, are making waves across the hotel industry in Europe, the Middle East, and Africa (EME). While these reforms are rooted in EU policy, their influence is increasingly felt beyond the area’s borders, affecting how hotels are financed, developed, and operated.

These regulatory shifts are driving a new standard of ESG performance. Hotel developers, operators, and investors are expected in near future to navigate a landscape where disclosing ESG data, aligning with sustainable building criteria, and managing ethical supply chains are no longer optional but essential for competitiveness.

One of the most consequential developments is the CSRD, which requires large companies to report ESG data using standardized metrics. Hotel groups with more than 1,000 employees must now disclose their energy usage, emissions, diversity figures, and more. Even mid-sized players are choosing to comply voluntarily to meet the expectations of banks and investors. Meanwhile, the CSDDD holds companies legally responsible for identifying and mitigating human rights and environmental risks across their value chains, from construction contractors to suppliers of hotel amenities. For hotel groups, this means establishing robust due diligence systems and rethinking procurement strategies.

Hotels with Top ESG Ratings Can Command a 4.8% Premium

Based on a Weighted Average of Midpoint Estimates

The EU Taxonomy adds another layer, classifying which economic activities qualify as environmentally sustainable. For hotel developers, this provides a framework to access green capital. Properties that meet criteria like superior energy efficiency or low emissions are more likely to secure green loans or sustainability-linked financing.

The Omnibus Directive, part of the EU’s broader legislative push, complements these efforts by reinforcing transparency, improving enforcement, and ensuring consumer-facing sustainability claims are accurate and verifiable. This is especially relevant for hotel operators marketing green credentials online or making ESG claims to consumers and investors alike.

These policy shifts are not merely regulatory hurdles. They are also shaping market behaviour. Hotels that meet ESG standards are now at a clear advantage. For example, CitizenM, a European hotel brand, refinanced debt through sustainability-linked loans tied to energy efficiency and green certifications. In Saudi Arabia, Red Sea Global secured $3.8 billion in green financing by committing to regenerative tourism principles and renewable energy.

Design and operational practices are evolving as a result. New hotel developments are increasingly built to LEED or BREEAM standards, outfitted with energy-saving systems, waste management protocols, and sustainably sourced materials. These enhancements not only appeal to eco-conscious guests but also reduce long-term operating costs and meet investor ESG criteria.

Across the EME region, countries are responding in diverse but complementary ways. In the United Arab Emirates, Dubai has implemented the Sustainable Tourism Stamp, requiring hotels to meet 19 ESG criteria. International events like COP28 have only accelerated this transition, with global brands such as Hilton actively participating in green initiatives.

In Saudi Arabia, sustainability lies at the heart of its Vision 2030. Projects like NEOM and The Line aim to set new global standards for sustainable tourism. Red Sea Global, a flagship regenerative tourism project, has already demonstrated how ESG excellence can attract massive green funding.

In France, the hospitality sector has long been at the forefront of ESG compliance. Companies like Accor publish annual vigilance plans addressing supply chain ethics and environmental risks. Executive pay is increasingly tied to ESG performance, embedding sustainability into corporate governance. In Spain, hotel groups like Meliá and NH Hotels are pioneering ESG-linked financial instruments, securing green loans and retrofitting older properties for energy efficiency. Coastal and island resorts are particularly active, aiming to protect natural resources while enhancing appeal to European ESG-focused investors and tour operators.

The direction of hotel development is clear. Sustainability is no longer a niche concern but a mainstream driver of value and resilience in hotel real estate. EU regulations have triggered a shift that extends far beyond compliance, setting a new bar for transparency, accountability, and innovation. Hotels that take a proactive approach to ESG reporting, green construction, and responsible operations will be best positioned to secure investment, build trust, and thrive in a market where sustainability is fast becoming a license to operate.

Insurances

Rising commercial property insurance costs are expected to increase by 80 percent in the United States by 2030, are posing a significant challenge for hotel owners. Insurers are becoming more cautious, tightening coverage, imposing restrictions on higher-risk operations, and requiring stronger risk mitigation measures. In this environment, hoteliers must manage coverage efficiently and control costs to maintain financial resilience.

At the same time, improving broad macroeconomic conditions offer a more optimistic outlook. Declining inflation and rising real wages are expected to support travel demand and consumer spending, providing a boost to the hospitality sector. Lower interest rates may ease financing conditions, though geopolitical tensions and global trade disruptions still pose risks to broader economic growth. Persistent labour shortages also continue to pressure the bottom-line, especially in service-driven sectors like hospitality.

To stay ahead, hotel owners and investors must take a proactive approach and carefully balancing insurance costs, financing strategies, and workforce planning to sustain profitability in a rapidly evolving economic landscape.

Hotels' yield advantage over other asset classes, combined with inflation-hedging through dynamic pricing, reinforces their appeal to private debt investors.

Private Debt in Hotel Developments

Private debt has become an essential component of institutional investment strategies, offering diversification, yield, and resilience in a shifting financial environment. Traditionally involving non-bank lending across sectors like corporate finance, real estate, and infrastructure, the private debt market gained traction post-financial crisis as banks tightened lending. With predictable cash flows and low correlation to public markets, private debt remains appealing even amid rising interest rates. Projections suggest the market could more than double by 2028. Institutional participation is evolving from fund-of-funds and consultants to direct investments and in-house platforms. Within this trend, hotel real estate has emerged as a prime target for private credit, with expected investment growth of 15–25% in 2025. Hotels' yield advantage over other asset classes, combined with inflation-hedging through dynamic pricing, reinforces their appeal to private debt investors.

Key segments in private debt include corporate lending, real estate, and infrastructure, each offering distinct return profiles and risk-reward dynamics. Corporate debt remains dominant, while real estate hybrid debt is stepping in to fill the void left by more conservative bank financing, returns in mezzanine hotel debt structures generally range from 10–12%, though select high-risk cases can reach up to 16%. Infrastructure debt is gaining momentum, particularly in renewable energy. However, upcoming Basel III regulations in 2025 will tighten bank financing further by requiring higher equity against mortgage loans, pushing more borrowers toward private credit. As a result, private debt is positioned to play an even greater role in financing hotel developments and acquisitions, particularly as institutional investors seek ESG-aligned opportunities in a more regulated and selective lending environment.

Private Debt is here to stay. Its ability to adapt to economic cycles, provide stable returns, and diversify institutional portfolios underscores its importance

Tariffs and Trade Wars

The information presented reflects a high-level analysis of current and potential impacts of tariffs and trade dynamics on the hotel industry. Readers are advised that trade policies and their implications are fluid and subject to rapid change. As such, the observations provided herein should be interpreted within the context of evolving geopolitical and economic conditions.

Demand Disruption Across Segments

Geopolitical tensions, particularly those involving tariffs and trade wars, pose significant risks to the hotel industry across Europe and the Middle East. While tariffs do not directly target hotel services, they have cascading effects that can significantly reduce hotel demand. Trade conflicts often result in economic slowdowns, currency volatility, and strained diplomatic relations, which in turn weaken both international leisure and corporate travel. Luxury hotels are typically the most exposed, as they rely heavily on high-spending international guests. Meanwhile, economy and midscale segments may see more resilient demand, particularly from domestic or regional travellers, although group and MICE segments can also experience sharp declines as businesses curb travel budgets.

Rising Development Costs and Feasibility Pressure

Hotel development costs are among the most immediate areas affected by tariffs. Construction materials such as steel, aluminium, glass, and ceramics are often imported, and tariffs on these goods can increase input costs by 10–25%. This was evident during previous global trade tensions when steel and aluminium prices surged following the imposition of tariffs. In both Europe and the Middle East regions that rely on globally sourced construction inputs. Such increases can derail feasibility calculations, force redesigns, or delay groundbreakings. Luxury developments are particularly vulnerable due to higher import content and fit-out standards, while midscale and economy projects may shift toward modular or standardized designs to contain costs.

Operational Cost Inflation and Sourcing Challenges

Operational costs also rise in a trade war environment, affecting everything from food and beverage procurement to maintenance and capital expenditures. Tariffs on imported FF&E, specialty foods, and cleaning supplies can increase daily operating expenses. Currency volatility can further complicate procurement for properties dependent on cross-border supply chains. In response, operators may look to local sourcing, renegotiate supplier contracts, or delay non-essential renovations. However, these measures can only go so far before service quality or brand compliance is affected.

Shifting Investor Sentiment and Underwriting Discipline

Investor expectations shift rapidly in uncertain geopolitical conditions. Risk-adjusted return requirements rise, especially for developments in secondary markets or those targeting highly international demand segments. Many investors become more conservative, favouring core urban assets or well-established brands with proven track records. Survey* data from late 2024 showed that nearly half of hotel investors in Europe cited geopolitical risks including trade tensions as a top concern, leading to increased due diligence periods and more selective underwriting. Some well-capitalized investors may treat periods of heightened uncertainty as opportunities to acquire discounted assets, but the broader sentiment generally leans cautious.

Lending Tightens Despite Rate Adjustments

The lending environment typically tightens as well. Commercial banks and alternative lenders respond to uncertainty by increasing debt service coverage requirements, lowering loan-to-cost ratios, and shortening loan terms. This conservatism reflects the expectation of potential revenue volatility and development cost overruns. At the same time, central banks may adjust monetary policy in response to economic impacts of trade disputes, cutting rates to stimulate growth or raising them to combat tariff-induced inflation. The outcome is often a mismatch: while base rates might decline, lending spreads widen, keeping the overall cost of capital high for hotel projects.

Yields, Contingencies, and Development Resilience

These factors collectively impact yields and development contingencies. Cap rates may rise slightly as investors price in greater uncertainty and demand higher risk premiums, particularly in non-core locations. Development contingencies must also be adjusted; prudent developers are now incorporating up to 10–15% buffers in construction budgets and stress-testing their financial models for scenarios involving supply chain disruptions that might prolong development phase or inflation. Forward procurement, flexible phasing, and increased focus on conversion rather than new-build are practical tools for risk mitigation. Ultimately, hotel stakeholders must adopt a flexible and forward-looking approach to navigate the operational and financial headwinds that tariffs and trade wars present.