Global Tourism Outlook

The European hotel market is poised for continued growth in 2025, with international tourism expected to rise by 3-5%, driven by economic stability and increasing demand from Asia-Pacific and U.S. While the rapid post-pandemic recovery seen in 2023 and 2024 is slowing, industry sentiment remains optimistic, with 64% of experts in the UN Tourism Confidence Index predicting improved conditions. However, economic uncertainties, inflation, high travel costs, and staffing shortages remain challenges, leading Fitch Ratings to maintain a neutral sector outlook. Hotel performance across Europe is expected to stay strong, though slightly softer than in 2024 due to fewer large-scale events boosting demand.

The luxury segment continues to show resilience, while business travel is steadily recovering, with increasing bookings for meetings, conferences, and corporate events. Despite these uncertainties, stable demand fundamentals, controlled supply, and strategic pricing are expected to support revenue stability across the sector. Additionally, changing consumer preferences, particularly in the US and EMEA, but also China (for further information see please article: China’s Tourism Recovery and Importance to Europe), show a growing shift toward spending on travel and experiences, fuelled by greater flexibility in remote work.

Demand for Airlines Increases, But Capacity Constraints Slows Performance Down

The aviation industry in 2025 will continue facing capacity constraints due to ongoing MRO issues and aircraft production delays, limiting growth to 3-4%. Corporate travel demand will recover gradually, stabilizing global load factors, while airfares are unlikely to drop significantly despite lower oil prices, due to supply shortages: aircraft deliveries in 2024 experienced a shortfall of 575 planes, representing approximately 30% of the planned deliveries and rising operational costs.

The expansion of long-range single-aisle aircraft will introduce new routes, particularly across the North Atlantic and Asia. Airport infrastructure will see progress, with major openings in China and India, while runway expansions in London remain uncertain. Korean Air’s long-awaited merger with Asiana is expected to proceed, and at least one major airline merger or acquisition is anticipated in Europe. eVTOL aircraft may begin operations in California, improving airport connectivity. Meanwhile, some governments may reconsider strict sustainability regulations due to economic impacts, balancing environmental goals with industry growth. Taking everything under consideration, the global passenger traffic is set to surpass pre-pandemic levels in 2024 (9.5Bn), exceed 12Bn by 2030, and double to 19.5Bn by 2042.

RevPAR Growth Stabilises to Single Digits

The European hotel market in 2025 is expected to benefit from favourable economic conditions, including declining interest rates, a strong U.S. dollar, and lower fuel costs, which should stimulate international travel and hotel revenue growth. In 2024, global RevPAR saw a 15% increase compared to 2019, largely driven by exceptionally high ADR, fuelled by major global events such as Taylor Swift’s Eras Tour. While 2025 is unlikely to see the same level of event-driven surges, hoteliers remain optimistic about steady performance, supported by healthy consumer spending and sustained leisure demand.

RevPAR is projected to continue growing in 2025, albeit at a more moderate pace, as demand stabilizes following the post-pandemic recovery. Key urban markets, including Paris, Madrid, Rome, and Milan, are expected to remain strong performers, while the UK hotel sector could attract more international visitors due to a weaker pound, despite slower domestic economic growth

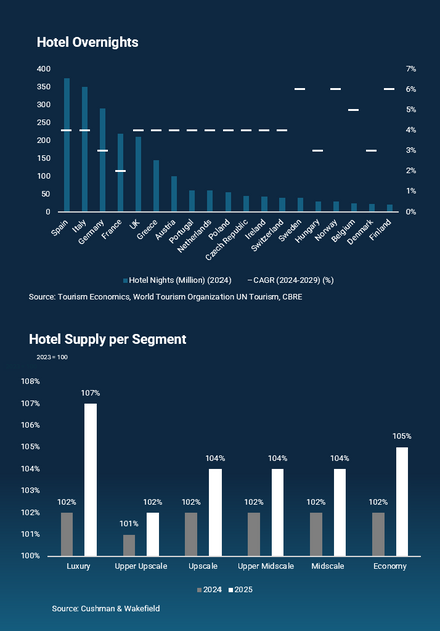

Overall hotel stays across Europe are anticipated to increase, with Spain, Italy, and Germany maintaining their lead in total visitor numbers, while Sweden, Norway, and Finland are set to experience faster growth rates of around 5-6% CAGR. However, geopolitical risks and potential supply constraints in select markets may create challenges. Nonetheless, with solid demand fundamentals and strategic pricing adjustments, the European hospitality sector is well-positioned to maintain its resilience throughout 2025.

Supply and Demand Showing Positive Forecast

The European hotel market is set for continued expansion in 2025, though rising development costs and financial constraints are slowing new supply growth. While Brussels, Dublin, and Warsaw are projected to surpass 2023 supply levels by 6-10%, overall development activity remains hampered by high interest rates and construction expenses. This is particularly challenging for fully leased hotel models in Central Europe, where fixed rental obligations have strained financial performance over recent years. As a result, hotel operators are increasingly shifting toward asset-light models, joint ventures, and sale-leaseback transactions to reduce capital risk.

To navigate high borrowing costs, investors are focusing on value-add strategies, including hotel conversions and adaptive reuse projects, particularly in markets where demand is growing. The conversion of office buildings into hotels is gaining traction, driven by changing workspace trends and limited new supply in key urban areas. Additionally, ESG considerations are playing an increasing role in investment decisions (please see article for further information: ESG in Hotel Real Estate –Thinking Long Term), with sustainability-linked financing, energy-efficient hotel developments, and carbon-neutral initiatives aligning with EU climate goals. Despite financial hurdles, business travel is rebounding strongly, with corporate-related hotel stays forecasted to grow by over 30% compared to 2023 levels. Investors who prioritize strong financial fundamentals, balanced LTV ratios, and operational efficiencies will be best positioned to capitalize on Europe’s resilient hospitality market in 2025. As airline capacity increases and direct routes expand, international arrivals in key and emerging markets will further drive growth, presenting strategic opportunities for hotel operators who can adapt to shifting demand trends and optimize pricing strategies.

The hotel market segmentation supply forecast for 2025 indicates a notable divergence in growth rates across different categories. The luxury and economy segments are expected to see the highest performance increases, reaching 107% and 105% of 2024 levels, respectively (read more about luxury hotel market from: Luxury Hotel Market Performance - Demand Remains Strong).This suggests that operators and investors expect high-end travellers remain willing to pay premium rates, while the budget-conscious segment continues to thrive due to flexible pricing model. Meanwhile, upscale, upper midscale, and midscale hotels are projected to grow at 104%, maintaining steady expansion, but at a more moderate pace. Moreover, existing midmarket and upscale hotels present a strong opportunity for opportunistic investors as they have an opportunity to enhance performance through rebranding, light refurbishments, and operator changes to receive immediate returns in comparison to newly build hotel projects.

Evolving Sources of Capital for Hotel Investment

The European hotel sector is witnessing a shift in financing dynamics as investors adapt to changing macroeconomic conditions. Private equity remains the dominant source of equity financing, with 36% of respondents expecting it to be the primary source of capital in 2025, an increase from 31% in 2023. Real estate funds and REITs are also projected to play a notable role (15%), though sovereign wealth funds and hotel funds are expected to lose momentum. This shift reflects evolving investment strategies, as institutional investors and family offices become more selective in deploying capital.

Traditional debt financing is regaining prominence, with 54% of respondents expecting it to be the primary financing source for hotel acquisitions in 2025. Senior bank loans, which saw reduced activity during the high-interest rate environment of the past two years, are now expected to rebound, with 37% of investors citing them as a key funding mechanism. However, alternative lenders, which previously dominated the space, are seeing a decline in preference, falling from 55% in 2024 to 43% in 2025.* This suggests a move back towards conventional lending structures as interest rate cuts improve the cost of debt.

Geographic Shifts in Capital Flows

Investment in European hotels is expected to be driven primarily by European investors, with 59% of respondents anticipating regional capital as the dominant source. North American investors continue to play a significant role, with 41% identifying it as a key funding source, while the Middle East and North Africa region is becoming an increasingly important contributor, cited by 36% of investors. In contrast, Asian investment remains subdued, with only 4% of respondents expecting Chinese capital inflows, and India’s involvement is even lower at 3%.* The trend reflects the continued dominance of Western capital in European hospitality financing, with established financial hubs leading investment activity.

Notably, sovereign wealth funds from the Middle East, have been stepping up their acquisitions of luxury hospitality assets in Europe. Investors from these regions are targeting prime markets such as London, Paris, and Madrid and Rome As a result, institutional investors and SWFs are expected to continue to play a larger role in shaping the European hotel landscape, leveraging their financial strength to capitalize on high-performing assets in key gateway cities.

The Impact of Financing Conditions on Hotel Transactions

Despite improving borrowing conditions, securing attractive debt financing for hotel development projects remains challenging. Loan-to-value ratios across Europe are trending toward 50/50, however, most projects require developers to commit even higher equity to access debt financing. This poses difficulties for new hotel developments, where higher risk premiums necessitate a compelling return potential. As a result, investors are increasingly favouring established markets with strong demand fundamentals, such as London, Paris, Copenhagen, and key leisure destinations in Southern Europe. Given these constraints, alternative financing structures, including joint ventures and sale-leasebacks, are gaining traction as developers look for creative ways to secure capital while minimizing risk exposure.

Looking ahead, capital market conditions for hospitality investments are expected to improve, with 76% of respondents in Deloitte’s Hotel Investment Survey anticipating stronger capital flows into the sector. However, investor selectivity will remain high, with a focus on prime assets in demand-driven locations or value-add opportunities through repositioning strategies. Middle Eastern sovereign wealth funds and North American institutional investors are likely to play an increasing role, targeting high-quality assets with long-term income potential.

Hospitality Investment Volume and Yield Trends

Investment activity in Europe’s hospitality sector rebounded significantly in 2024, with total volume reaching €20 billion by end of the year, a notable recovery from €10 billion over the same period in 2023. This resurgence highlights renewed investor confidence, owners pressured to sell, yields slowly decreasing and fuelled by the continued growth of both leisure and business travel. Hotel assets have shown resilience amid economic uncertainty, particularly due to their inflation-hedging characteristics, which allow for dynamic rate adjustments in response to market conditions.

Additionally, hospitality yields, which had previously expanded during the high-interest rate environment of 2022-2023, are now stabilizing, providing investors with a more predictable return landscape. The sector's ability to command premium yields over other asset classes has further strengthened its appeal among institutional investors. Despite these positive trends, hotel investors and developers must remain strategic in navigating a more disciplined lending environment. While financing conditions are gradually improving, lenders continue to favour projects with strong equity returns, robust market positioning, and a clear demand-driven investment strategy. Investors focusing on prime assets in high-growth locations or value-add repositioning opportunities will be best positioned to capitalize on the European hospitality sector’s ongoing recovery and expansion.

The Impact of Financing Conditions on Hotel Transactions

The European hotel transaction market in 2024 has displayed a stark contrast between high-growth and declining regions. The UK saw a remarkable 238% increase in transaction volume, while Ireland led all markets with an impressive 479% growth. Italy, the Netherlands, and Scandinavia also recorded solid expansion, driven by strong investor interest and resilient tourism demand. This surge reflects a shift in capital allocation toward markets with stable economic conditions and favourable investment environments.

However, Spain, France, and Portugal—key transaction hotspots in 2023—have seen significant declines this year. France’s transaction volume dropped by 23%, Spain by 19%, and Portugal experienced the steepest decline at -41%. These markets dominated deal activity last year, but rising financing costs, regulatory uncertainties, and shifting investor preferences have slowed activity in 2024. Meanwhile, Germany and Austria posted moderate but steady growth, signalling a more balanced investment landscape, but German’s investment landscape is trailing far behind 2019 levels. As the market evolves, investors are focusing on regions with stronger fundamentals and liquidity. Southern Europe might face challenges in attracting new capital at the same levels as in 2023, even though Southern and Eastern Europe have benefited in previous years from lower development costs (Read more about hotel development costs from Europe's Hotel Development Landscape 2024 - Opportunities on the Horizon).

Hotel assets present multiple value-creation opportunities, outperforming many other asset classes in this regard. Furthermore, the sector’s strong recovery from various crises has solidified hospitality as a core asset class for investors.

Gradual Decline in Yields Expected in 2025 While Operational Costs Increases

Hotel real estate yields have remained relatively stable across major European cities in Q3-Q4 2024, with slight upward shifts in select markets due to ongoing macroeconomic pressures. However, as we move into 2025, yields are expected to decrease gradually, driven by improving investor sentiment and an anticipated stabilization of interest rates. That said, rising hotel operational costs—including wages, energy prices, and insurance premiums—may exert downward pressure on net operating income, particularly for hotels with weaker cost structures.

Additionally, real estate assets lacking a strong ESG rating could see lower investor demand, further affecting yields. Investors are increasingly prioritizing sustainability-compliant properties, as stricter regulations and higher financing costs for non-compliant assets continue to shape investment decisions. Consequently, while prime assets in resilient markets may benefit from yield compression, underperforming properties may struggle to maintain their value compared to 2019 levels.

Private Debt: A Growing Cornerstone in Institutional Investment Portfolios

Private debt has become a key driver of institutional investment strategies, offering diversification, yield, and stability in an evolving financial landscape. Traditionally, private debt refers to non-bank lending across sectors such as corporate financing, real estate, and infrastructure. The sector gained momentum following the global financial crisis, as tightened banking regulations and risk constraints opened the door for alternative lenders to bridge the financing gap.

Despite the recent surge in interest rates, private debt remains attractive due to its predictable cash flows and low correlation with public markets. Industry projections indicate that private debt markets could expand from $1.4 trillion to $3.5 trillion by 2028, highlighting its growing role in global capital allocation.

Market Trends and Institutional Participation

Institutional investors often enter the private debt space through fund-of-funds structures or with guidance from consultants. As experience builds, many shift to direct investments or dedicated funds. Some companies have initially relied on advisors before developing in-house capabilities.

As private debt solidifies its position in institutional portfolios, hotel real estate is emerging as a major sector utilizing alternative financing. With traditional banks pulling back on lending, private credit has stepped in to support hospitality transactions and developments. Market research indicates that hotel investment volumes could increase by 15-25% in 2025, further reinforcing private debt’s role in real estate financing.

Hotel real estate sector typically has higher yields than other main sectors, with prime assets generating 5-6% returns, allowing investors to absorb higher borrowing costs more effectively than office or retail properties. Additionally, dynamic pricing and inflation-hedging capabilities enable hotels to adjust room rates in response to rising loan yields, ensuring stable revenue growth despite elevated financing

Key Sectors in Private Debt

Corporate Private Debt: This remains the largest and most established segment, with senior secured loans preferred for their balanced risk-reward profiles.

Real Estate Debt: As traditional real estate financing becomes more restrictive, private debt is filling the gap. Whole loans in this space offer returns of up to 10%, while mezzanine loans yield 14-16%. However, real estate private debt remains underdeveloped in Germany compared to the US and UK, indicating potential for future expansion.

Infrastructure Debt: Though still developing, this segment is experiencing growth, particularly in renewable energy projects. Senior infrastructure debt returns range from 4-5%, while subordinated loans can yield up to 8-16%.

Challenges and Opportunities

Navigating the private debt space requires experienced fund managers with proven risk management and exit strategies. Investors are increasingly focusing on regulatory transparency and standardized reporting to enhance confidence in the sector.

While higher interest rates have increased private debt yields, sustainability and ESG factors are becoming essential considerations for investors. Assets lacking strong ESG credentials may face financing challenges, whereas sustainability-linked private debt is gaining traction as a viable funding solution.

Looking ahead, private debt is set to play a larger role in global hotel finance, particularly as traditional banks reduce lending exposure. With alternative lenders continuing to fill the capital gap, private debt is on track to remain a fundamental part of institutional investment portfolios in the years ahead for hotel development and acquisitions.

Implementation of Long Postponed Basel III

With the introduction of Basel III regulations in 2025, financing markets are set to face new challenges. Banks will be required to hold more equity capital against mortgages, increasing costs for property owners and developers. Higher refinancing expenses and a return to pre-negative interest rate margins will make borrowing more expensive, particularly for those with high loan-to-value (LTV) ratios. This shift means that financing for investment properties, especially multifamily housing, will become stricter. Banks may cap loans at 75% of the purchase price, and for LTVs above 60%, they will require even more equity, ultimately leading to higher mortgage interest rates for borrowers.

Private Debt is here to stay. Its ability to adapt to economic cycles, provide stable returns, and diversify institutional portfolios underscores its importance

Interest Rates

The 2025 interest rate outlook suggests a downward trend across most major economies, with central banks expected to cut rates in response to easing inflation and a shift towards economic growth. However, the US Federal Reserve remains cautious due to persistent inflationary risks, with expectations that it will pause rate cuts at 4.25% before further normalization in 2026. The European Central Bank, the Bank of England, and the Reserve Bank of Australia are all projected to lower rates, which will improve borrowing conditions and stimulate investment, particularly in the real estate and hospitality sectors.

Inflation is forecasted to decline across key markets, with the Eurozone expected to reach 1.9% and the UK at 2.3% in 2025. On 30th of January, the ECB’s Governing Council decided to lower the three key ECB interest rates by 25 basis points. Accordingly, the interest rates on the deposit facility, the main refinancing operations and the marginal lending facility will be decreased to 2.75%, 2.90% and 3.15% respectively, with effect from 5th February 2025. These could be also too optimistic as it is expected that ECB will hold rate cutting at some point.

The falling interest rates will enhance consumer confidence, supporting travel and hotel demand, particularly in major destinations such as Spain, Italy, and France, which are projected to see steady tourism growth. Lower interest rates should reduce financing costs for hotel developments, spark transactions, making expansion more viable, especially in markets with strong demand fundamentals.

However, risks remain. Investment divergence, particularly with the US pursuing domestic reindustrialization and AI-driven growth, could lead to capital outflows from other regions, affecting infrastructure investment in Europe and Asia. Additionally, inflation could return in shorter but more frequent cycles due to supply chain disruptions, energy price volatility, and potential trade policy shifts. Central banks may need to adopt a flexible approach, balancing growth support with inflation control.

For the hotel industry, the combination of lower interest rates, stable demand, and improving economic conditions bodes well for continued revenue growth. Business travel is set to maintain its recovery, and leisure travel, while stabilizing after post-pandemic peaks, will remain strong. The anticipated monetary easing should provide a favourable backdrop for hotel operators and investors, enabling continued expansion and strategic acquisitions in high-growth tourism markets.

Declining interest rates and improved liquidity are reigniting optimism in the hotel debt market, with lenders favouring hotels for their higher debt yields, diversification benefits, and inflation-resistant collateral.

At the same time, strong RevPAR growth, limited new supply, and high consumer spending on travel and experiences make hotels an attractive investment. Meanwhile, some distressed owners facing upcoming PIP requirements and maturing loans are under pressure to sell, creating attractive opportunities for opportunistic buyers

Economic Growth and Investment Outlook in 2025

The global economic outlook for 2025 suggests continued moderate growth, with global GDP projected to expand at 3.3%, marking the fourth consecutive year of above 3% growth. Developed economies, including the U.S. (+2.7%), the Eurozone (+1.0%), and the UK (+1.6%), are expected to see modest gains, while emerging economies will sustain more robust growth at 4.2% on average, driven by China (+4.6%), India (+6.5%), and Latin America (+2.5%). However, risks such as persistent inflation, geopolitical uncertainty, and trade disruptions could impact these projections.

Investment activity in the European real estate and hotel markets is expected to rise as financing conditions improve. With interest rates stabilizing and debt costs decreasing, positive leverage is becoming viable again, making hotel acquisitions and developments more attractive. The Euro-Dollar exchange rate is expected to remain favourable, encouraging the return of international capital, particularly from North America and the Middle East. As seller and buyer expectations align, transaction volumes are set to increase, although recovery will be gradual due to limited room for bid price improvements.

With significant capital still on the sidelines, investors are increasingly targeting value-add and opportunistic strategies before asset values fully recover. This trend suggests heightened activity in repositioning distressed or underperforming hotel assets to align with evolving consumer preferences and market conditions. However, potential headwinds—including slower-than-expected economic growth and inflation risks—could dampen momentum. Despite these challenges, European real estate’s return outlook remains compelling, positioning the hospitality sector for renewed investor interest in 2025.

Insurances

The rising cost of commercial property insurance, projected to increase 80% by 2030 (U.S.), is a growing challenge for hotel owners. Insurers are tightening policies, imposing restrictions on high-risk activities, and demanding stronger risk management measures. As a result, hoteliers must optimize coverage and control costs to maintain financial stability.

Meanwhile, falling inflation and rising real wages will boost consumer spending and travel demand, supporting the hospitality sector. Lower interest rates should improve financing conditions, but geopolitical risks and global trade disruptions could slow economic momentum. Labor shortages remain a key issue, potentially limiting expansion in service-heavy industries like hospitality. To pilot these challenges, hotel investors and operators must balance insurance costs, strategic financing, and workforce planning while ensuring profitability in a shifting economic landscape.