Ultra-Luxury Hotels Performance

The post-pandemic recovery has highlighted a striking shift in global luxury travel spending patterns, with ultra-luxury hotels significantly outperforming traditional luxury across key destinations in terms of ADR. Ultra-luxury hotels’ ADRs in cities such as Paris, London, New York, and resort destinations like the Maldives have surged well above 2019 levels. This reflects not only stronger pricing power but also the resilience of high-net-worth demand: the wealthiest travellers have returned to international travel faster, are staying longer, and are demonstrating far lower price sensitivity.

Even though ultra-luxury hotels often operate with lower occupancies than traditional luxury properties, this is increasingly seen as a feature rather than a flaw. Guests in this segment expect more space, greater privacy, elevated service levels, and frequently book at shorter notice - factors that structurally compress occupancy while supporting exceptionally high rates. For investors, this performance differential highlights the defensive nature of ultra-luxury assets, where rate growth, brand equity, and constrained supply collectively drive superior yields and long-term value creation.

At the same time, a broader cultural shift is reshaping luxury consumption. Affluent consumers - particularly younger high-income cohorts are allocating a greater share of their discretionary spending towards experiences rather than physical goods. Travel, wellness, gastronomy, and once-in-a-lifetime activities are increasingly viewed as status markers that exceed luxury accessories in perceived value. This evolution directly benefits the luxury hospitality sector, as travellers are willing to pay premium rates for design-led properties, high-touch service, and emotionally resonant experiences.

Travel, wellness, gastronomy, and once-in-a-lifetime activities are increasingly viewed as status markers that exceed luxury accessories in perceived value.

Although the market able and willing to pay ultra-luxury rates is inherently smaller than the traditional luxury customer base, its spending power is considerably stronger. For investors evaluating the sector, the data signals a durable behavioural shift: luxury hotels are no longer merely places to stay - they have become a primary outlet for global luxury spending, positioning the segment for sustained and resilient growth.

Willingness to Pay for Luxury Travel Continues

Building on these dynamics, the broader luxury hotel sector continues to post robust growth, supported by sustained demand for high-end travel and the expansion of global wealth. According to recent market analysis*, the luxury hotel market is forecast to grow from USD 113.1 billion in 2024 to USD 181.5 billion by 2034, reflecting a CAGR of 4.9%. Key drivers include the rise of bleisure (business-leisure) travel, the adoption of digital concierge and smart-room technologies, and the expanding population of high-net-worth individuals. Meanwhile, the number of hotels charging over USD 1,000 ADR has more than doubled since 2019, emphasising travellers’ willingness to pay for exclusivity and personalisation.

Performance data from leading operators such as Mandarin Oriental reinforces this momentum: in the first half of 2025, the group’s RevPAR increased by 11% year-on-year, with particularly strong results in the EMEA region, where RevPAR reached USD 677. This continued rate-driven growth, coupled with the sector’s resilience and limited new supply, demonstrates why luxury hospitality remains one of the most attractive and inflation-resilient real estate segments for investors.

The number of luxury hotels charging over $1,000 ADR has risen sharply, growing at a 20.2% CAGR between 2019 and 2024. This rapid expansion highlights the sector’s increasing pricing power and the strengthening demand for ultra-luxury hospitality.

In addition to strong global performance, regional data further underlines how luxury hotels are consistently outpacing the broader market. In Copenhagen, for instance, the luxury segment recorded a remarkable 35% growth in ADR between 2019-2024, compared with a 13% increase in the upscale category and a 13% rise in boutique hotels. This outperformance demonstrates both the strength of demand for high-end products and the ability of luxury operators to command premium pricing despite broader market normalisation.

Supported by a relatively limited supply pipeline and the rising appeal of Nordic capitals to affluent international travellers, Copenhagen exemplifies the structural advantage of the luxury segment - where rate growth and brand prestige translate directly into superior asset performance and investor returns.

Experiences, the New North Star in Luxury?

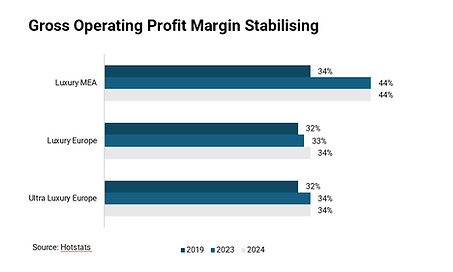

The luxury hotel sector may have outpaced the broader market in average daily rate growth, but it is no exception to the arithmetic of rising operating costs. Payroll, utilities and supplier expenses have all marched higher, causing potential compression risk of gross operating profit margins even as top-line figures remain robust. The result is a paradox familiar to many asset-heavy investors in an inflationary environment: record revenues paired with stubbornly static operational profitability.

In response, an increasing number of luxury brands are repositioning themselves less as traditional accommodation providers and more as curated lifestyle destinations. The industry’s forward-looking operators are shifting value creation away from the commoditised aspects of hospitality and towards highly bespoke, high-margin experiential services.

Today, the lucrative revenue streams are often not just found in rooms, spas or restaurants but in activities such as husky safaris in Lapland, truffle-hunting excursions in Piedmont or guided mountain-gorilla treks in Rwanda. Typically delivered in partnership with specialist local providers, these experiences are wrapped in brand standards and sold as seamless extensions of the hotel’s identity. For guests at the ultra-luxury end of the spectrum who are increasingly inclined to spend thousands of euros on singular, curated moments - margins on experiential offerings can exceed 50%, well above the returns generated by conventional F&B operations.

This consumer behaviour reflects a broader shift among high-net-worth individuals, who continue to divert discretionary spend away from material goods and towards memory-making. Guests may struggle to recall the precise dimensions of their suite or the particular shade of marble in the bathroom, but they will evangelise for years about the once-in-a-lifetime adventure a hotel facilitated.

In a sector where differentiation is paramount, such stories are becoming a currency of their own.

Margins Under Pressure as Structural Costs Rise

Despite resilient demand fundamentals, GOP margins across Europe and the Middle East have, in recent years, stabilised rather than widened. The sector now faces a convergence of structural headwinds well known not just luxury hotel, but to all real-estate investors. Higher fixed costs, refinancing challenges as debt matures and increasingly capital-intensive, brand-mandated renovation cycles all weigh on asset performance. Meanwhile, the competitive landscape grows more crowded as a new wave of luxury supply comes to market, exerting further pressure on owners to reinvest.

Overlaying these dynamics are ever-tightening ESG requirements, driven not only by regulatory frameworks but by the expectations of brands, investors, lenders and guests. While such upgrades promise long-term value accretion, they demand substantial upfront capital - yet another claim on balance sheets already stretched by rising costs of capital and escalating operational outlays.

The strategic imperative is clear: luxury hotels must increasingly rely on differentiated, experience-led revenue streams to protect and expand profitability. In an era where cost inflation shows little sign of abating, it is the most innovative operators - those who treat their properties as platforms for rare, authentic experiences - who are best positioned to defend margins and capture the evolving preferences of global luxury travellers.

Demand is for Luxury is Expected to Grow

The ultra-high-net-worth individual (UHNWIs) segment is anticipated to experience significant growth over the coming years, with an increase of over 28% expected between 2023 and 2028. The highest concentrations of UHNWIs are seen North America, with growth in regions like Asia, where the number is projected to see notable increases, reflecting a strong rise in wealth accumulation. This growth is expected to impact luxury hospitality, as affluent individuals increasingly seek memorable experiences.

In parallel, the luxury leisure hospitality sector is projected to see a compound annual growth rate of 10% from 2023 to 2028, driven by various wealth segments. The highest spending growth is anticipated among high-net-worth and very high-net-worth individuals, although significant spending increases are also expected by aspiring luxury segments. These trends emphasise the expanding demand for luxury leisure hospitality, driven by wealth growth across different tiers, and stress the sector’s potential for capturing this high-value clientele in the coming years.

The global distribution of USD millionaires is set to grow significantly from 2023 to 2028, with notable regional variations. North America remains a dominant region, with the United States expected to see an increase from approximately 21.9 million millionaires in 2023 to 25.4 million by 2028, reflecting a growth rate of 16%. Canada and Mexico are also projected to experience substantial increases, with Mexico growing by 24% and Canada by 21%. Europe shows mixed trends. Sweden, Norway, and Switzerland are expected to experience double-digit growth, with increases of 22%, 27%, and 16%, respectively. However, some countries are projected to see declines in millionaires.

Asia stands out with remarkable growth in countries like Taiwan, Turkey, and Kazakhstan, each projected to grow by over 40%. China, the largest Asian market by volume, is expected to increase its millionaire population from 6 million in 2023 to 6.5 million by 2028, an 8% growth rate. Other regions, such as Africa and South America, show promising growth as well. Australia's millionaire population is projected to grow by 21%, highlighting the strength of wealth accumulation across different continents.

Luxury Hotel Development Costs

As brands, developers, and investors anticipate sustained demand for luxury hotels, brands have established robust pipelines to meet this demand. However, luxury hotels come with significantly high development costs, with notable variations across regions. For instance, development costs per segment indicate that luxury properties allocate a substantial portion to land (7%) mostly due to premium location and larger GFA per room, building and site improvements (63%), and soft costs (16%), with additional allocations for FF&E, pre-opening expenses, and developer fees.

In Western markets, luxury hotel development costs typically range from €600,000 to €1.2m per key and can rise well beyond that when historical preservation requirements, bespoke design elements, or curated art collections are involved.

Across Europe, the cost disparity is evident, with countries like Sweden, Finland, and the UK experiencing some of the highest development costs, while markets like Portugal and Spain are on the lower end. This variation emphasizes the challenges in aligning development budgets with market expectations, especially when constructing international hotels to Western European standards.

Pipeline of Luxury Hotels Across the World

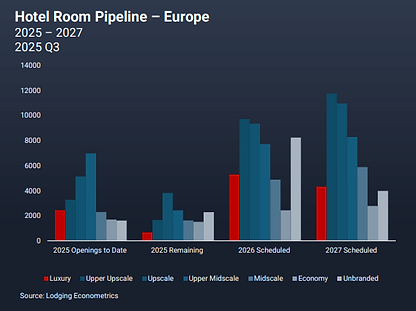

As the global luxury hospitality market continues to expand, investor appetite for high-end accommodation shows little sign of waning. Projections for the demand remains sufficiently robust to sustain a strong development pipeline across the world’s key gateway and resort markets, with capital still gravitating toward trophy assets that promise both scarcity value and enduring pricing power.

The European pipeline also angles to materially smaller hotels: upcoming projects average roughly 123 keys, compared with about 221 keys in the Middle East, where developers continue to favour expansive, master-planned hospitality schemes backed by sovereign or institutional capital. This divergence emphasises the differing market dynamics at play. Europe’s preference for heritage-led conversions versus the Middle East’s inclination toward large, fully integrated luxury developments and highlights how investors increasingly weigh brand alignment, operational scale and capital efficiency when deploying funds into the sector.

In Europe Independent Hotels Maintain Stubborn Foothold

Over the past quarter-century, the number of luxury hotel rooms in Europe has nearly doubled, yet the balance between independent and branded properties has remained strikingly stable.

This persistence reflects investors’ longstanding affinity for independently owned, often family-held assets and the traditional owner-operator models that still define much of Europe’s hospitality landscape. Independence continues to command a premium, supported by heritage, strong local identity and operational autonomy: qualities that many owners remain reluctant to cede, even as institutional capital deepens its interest in the sector.

Independent luxury hotels have therefore maintained a stubborn foothold, but the market is edging towards a period of transition. Generational change across legacy assets, shifts in ownership structures and rising capital requirements particularly for refurbishment and ESG compliance are likely to create openings for brands to secure a foothold in historically inaccessible portfolios.

Europe’s forward pipeline mirrors the established split between branded and independent properties, implying that incremental brand growth will rely less on new development and more on carefully structured conversions, partnerships and management agreements with long-standing independent owners.

For luxury brands, quality must come before scale and if executed well, scale will follow. As development headwinds persist, the next openings may lie within independent hotels facing generational transition.

This dynamic stands in contrast to Asia-Pacific, where the pipeline of chain-affiliated luxury hotels is more than twice the size of Europe’s, reflecting both a more consolidated market and a more mature embrace of brand-led operating models. For global operators seeking to expand in Europe, the strategic imperative should be clear: prioritise quality, not scale for its own sake.

In the luxury segment where differentiation, authenticity and service excellence command the strongest pricing power, disciplined curation will deliver more durable value than rapid proliferation. Scale, in this context, is best viewed not as a starting ambition but as the natural by-product of trust earned and performance sustained over time.

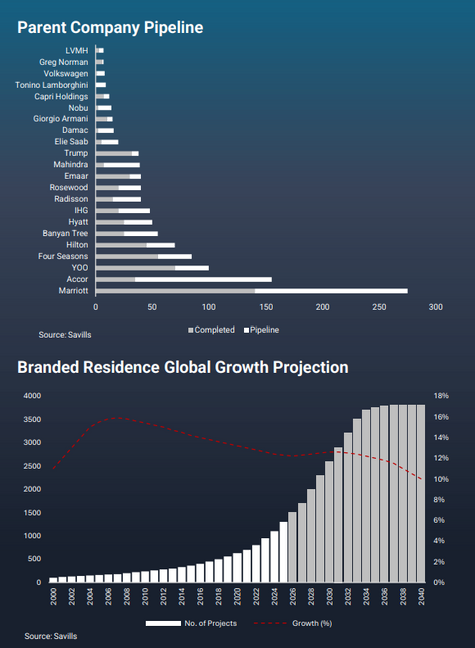

Branded Residences Enabling the Development of Luxury Hotels

Branded residences are increasingly becoming integral to luxury hotel developments because they provide a robust financial foundation from the outset. The introduction of a branded-residential component allows developers to tap into upfront capital via off-plan sales - often starting with a small deposit (5-10 %) followed by milestone payments that may reach up to 70 % of the unit value prior to handover.

This early cash flow reduces dependence on construction loans and mitigates execution risk, thereby improving debt serviceability and enhancing the lender’s confidence in the hotel component.

From a sizing, timing of the cashflows and structuring perspective, branded residences also support higher project valuations and returns.

The branded units typically command price premiums of up to ~30 % above comparable non-branded homes, thanks to the association with a luxury hotel or hospitality brand and the access to its services, amenities and guest-pool infrastructure. By enhancing the overall revenue base, the addition of a high-margin residential arm increases the total return profile, lowers the overall blended cost of capital, and helps stabilise cash flows throughout the asset life-cycle - all key drivers when modelling luxury hotel investments especially considering the higher costs and expanding length of developing a luxury hotel before the hotel starts to generate cashflow

Shaping the Future Through Brand Identity

It is clear that powerful and recognisable brand identity, immersive experiences, and branded residential components are not merely passing trends but structural forces shaping the future of luxury hotel development. In an increasingly competitive market, where differentiation is essential and guest expectations are progressively higher, a distinctive brand narrative has become a primary driver of value - one that conveys far more than luxury alone. This evolution is clearly reflected in the strategic direction of leading operators. Hilton’s new Pursuit of Adventure initiative and Rosewood’s reimagined brand identity which both are centred on discovery, cultural connection, and purpose, illustrating how major brands are repositioning themselves from accommodation providers to fully fledged experiential lifestyle platforms.

Experiences as the New Luxury Currency

Curated experiences have meanwhile emerged as the most effective lever for premium pricing, guest loyalty, and long-term brand strength. Today’s luxury travellers prioritise authenticity, wellbeing, and meaningful engagement over traditional displays of luxury, favouring hotels that offer deeply personal and locally rooted experiences without forgetting key pillars of luxury.

Even though ADR and demand are growing, some luxury hotels continue to face challenges retaining sufficiently high GOP margins. High-margin, high-priced experiences may represent a new avenue for luxury hotels. As global wealth continues to expand, particularly within high-net-worth and ultra-high-net-worth segments, demand for these immersive, emotionally resonant journeys is set to accelerate, positioning experiential luxury as the highest-growth segment within hospitality.

Branded Residences Reinforcing the Future of Development

Finally, branded residences are reinforcing the financial foundations of luxury hotel development, providing the upfront capital that makes such projects viable in high-cost markets. With significant price premiums and resilient demand, branded residences have become a critical component of the luxury development model, especially in light of high development costs and lengthening project timelines.

The 20.2% CAGR in hotels achieving over $1,000 ADR between 2019 and 2024 underlines the pricing power generated by strong brands with compelling experiential ecosystems. At the same time, the merging of hospitality, residential living, and curated lifestyle offerings means luxury hotels are evolving into multi-dimensional destinations rather than stand-alone assets.

Even though luxury has led market performance and dominated headlines with multi-million-per-key transactions, today’s environment presents growing challenges. Lengthening development timelines, high LTVs often requiring a CMBS–private credit mix, elevated construction costs, rising fixed expenses, and an increasingly crowded brand landscape all put pressure on feasibility. For developers and operators seeking investors beyond family offices - are required to create invest in the identity of hotel and source new high margin profit streams.

For developers, investors, and global brands, the conclusion is clear: a strong and recognisable brand identity, highly curated experiences, and the integration of branded residences into the overall development model represent both the present and the future of luxury hospitality.

With disciplined asset management, a clear strategic vision and a willingness to deploy creative, multi-stakeholder solutions, even the most capital-intensive luxury hotels can be positioned into compelling investments, attractive not only for their long-term asset value, but also on a purely cash-flow basis.