Luxury Hotels Attract Investors and High Paying Guest

The luxury hotel sector has seen impressive growth, with major brands maintaining substantial pipelines and continued expansion, affirming confidence in the market's capacity for more luxury properties. Luxury hotel transaction are now reaching a value per key around €1.7 million and above, reflecting robust bottom-line performance and investor optimism about future growth.

An ADR of €1,000 is no longer uncommon, particularly in Europe, where approximately 180 hotels have achieved this rate, with some seasonal properties even exceeding that. In resort destinations, food and beverage offerings, along with experience services, can account for nearly half of total revenue. Compared to 2019, the number of high-performing luxury resorts has doubled—and in some markets, even tripled. With a heightened focus on experiences across all demographics, from blue-collar workers to high-net-worth individuals, luxury hotels among the rest of hospitality industry face the challenge of creating unique and memorable experiences. Guests are increasingly willing to pay a premium for these distinctive offerings, pushing hoteliers to innovate and deliver beyond standard luxury.

A great example of high performance can be seen in brands such as the Oetker Collection. Comprising 11 hotels as of summer 2023, the brand experienced positive room rate growth, which drove its success, with RevPAR surpassing €1,000 as a weighted portfolio average for the first time. Another example is Mandarin Oriental, where RevPAR in EMEA reached $645 in 2023, marking a 14% increase from 2022.

Strong Performance Across Brands and Sustained Market Growth

Major hospitality groups have strategically invested in the luxury hotel segment due to its strong supply-demand dynamics, a decision that has proven wise as luxury hotels demonstrated substantial pricing power during the inflationary period of 2022-2023.

In hotel portfolios the inflation resilience has been especially evident in resorts, where net operating income has grown significantly faster than inflation (1970-2019). In recent years, especially the luxury hotels have had the ability to hedge well against inflation by adjusting room rates in response to strong demand.

From 2019 to 2023, the strong demand resulted in notable ADR growth across key cities; for example, London’s luxury ADR grew by 44% compared to the overall market’s 28%, while Paris saw a 42% increase in luxury ADR versus 38% citywide. In Milan, the market’s ADR managed to increase more than luxury.

The global luxury hotel market, valued at $140 billion in 2023, is projected to reach $369 billion by 2032, growing at a CAGR of 11.5%

The global luxury hotel market, valued at USD 140 billion in 2023, is projected to grow to USD 369 billion by 2032. This growth underscores the strong demand for high-end hotels worldwide, driven by affluent travellers seeking unique and premium experiences. When comparing brands, Six Senses is a strong market leader from selective major brands portfolios. Six Senses’ high RevPAR, aligns with recent high per-key transaction prices, emphasizing its premium market positioning.

Meanwhile, LXR has shown strong RevPAR growth due to likely new openings in high-performing markets with LXR’s limited original supply. Overall, the brands are performing well and a few notable brands such as Belmond, Rosewood and Four Seasons don’t release their operating performance numbers.

Demand is for Luxury is Expected to Grow

The ultra-high-net-worth individual (UHNWIs) segment is anticipated to experience significant growth over the coming years, with an increase of over 28% expected between 2023 and 2028. The highest concentrations of UHNWIs are seen North America, with growth in regions like Asia, where the number is projected to see notable increases, reflecting a strong rise in wealth accumulation. This growth is expected to impact luxury hospitality, as affluent individuals increasingly seek memorable experiences.

In parallel, the luxury leisure hospitality sector is projected to see a compound annual growth rate of 10% from 2023 to 2028, driven by various wealth segments. The highest spending growth is anticipated among high-net-worth and very high-net-worth individuals, although significant spending increases are also expected by aspiring luxury segments. These trends emphasise the expanding demand for luxury leisure hospitality, driven by wealth growth across different tiers, and stress the sector’s potential for capturing this high-value clientele in the coming years.

The global distribution of USD millionaires is set to grow significantly from 2023 to 2028, with notable regional variations. North America remains a dominant region, with the United States expected to see an increase from approximately 21.9 million millionaires in 2023 to 25.4 million by 2028, reflecting a growth rate of 16%. Canada and Mexico are also projected to experience substantial increases, with Mexico growing by 24% and Canada by 21%. Europe shows mixed trends. Sweden, Norway, and Switzerland are expected to experience double-digit growth, with increases of 22%, 27%, and 16%, respectively. However, some countries are projected to see declines in millionaires.

Asia stands out with remarkable growth in countries like Taiwan, Turkey, and Kazakhstan, each projected to grow by over 40%. China, the largest Asian market by volume, is expected to increase its millionaire population from 6 million in 2023 to 6.5 million by 2028, an 8% growth rate. Other regions, such as Africa and South America, show promising growth as well. Australia's millionaire population is projected to grow by 21%, highlighting the strength of wealth accumulation across different continents.

Luxury Hotel’s Revenue Broken Down

An example of strong luxury hotel performance in a European capital, London, is the Mandarin Oriental Hyde Park. This 181-room property achieved an occupancy rate of 67.1% in 2023, with an Average Daily Rate of $1,573, resulting in a RevPAR of $1,056. Across the broader luxury hotel market in London, the market manages to average RevPAR of £286, TrevPAR of £402, and GOPPAR of £143, achieving a GOP of 34%. During high-performing quarters, RevPAR can reach up to £344, with TrevPAR at £449. In resort destinations, room revenue as a percentage of total revenue can reach up to 50% due to high sales performance in food & beverages as well as experiences.

Luxury leads in terms of RevPAR growth in Europe with impressive 7,9% RevPAR YTD September growth, especially weekday performance has increased tremendously indicating potential return of business travellers, mixing leisure and business gathering speed in luxury segment.

Luxury Hotel Development & Pipeline

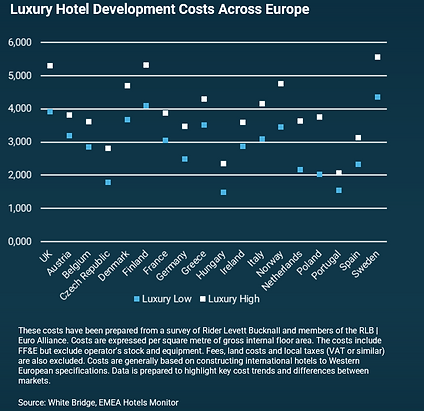

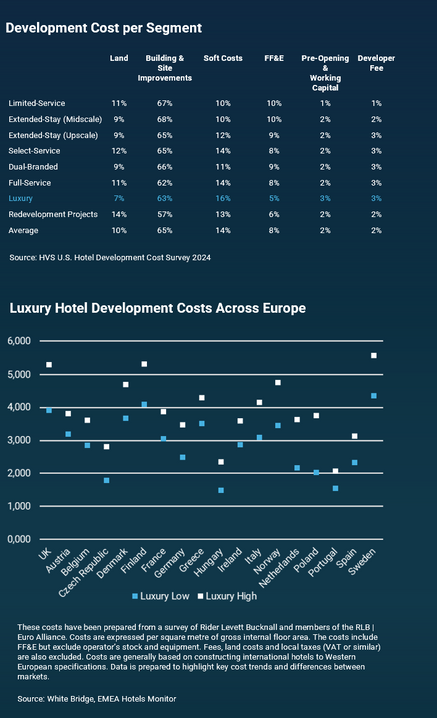

As brands, developers, and investors anticipate sustained demand for luxury hotels, brands have established robust pipelines to meet this demand. However, luxury hotels come with significantly high development costs, with notable variations across regions. For instance, development costs per segment indicate that luxury properties allocate a substantial portion to land (7%) mostly due to premium location and larger GFA per room, building and site improvements (63%), and soft costs (16%), with additional allocations for FF&E, pre-opening expenses, and developer fees.

Across Europe, the cost disparity is evident, with countries like Sweden, Finland, and the UK experiencing some of the highest development costs, while markets like Portugal and Spain are on the lower end. This variation emphasizes the challenges in aligning development budgets with market expectations, especially when constructing international hotels to Western European standards.

Moreover, with the introduction of Basel IV regulation, bank financing will persist to provide challenges for hotel developments with investors and developers bridging the gaps between equity and debt with hybrids such as mezz-debt. Although inflation is projected to slow, financing luxury hotel projects will still require creative solutions to navigate the regulatory landscape and high upfront costs, further impacting development feasibility and timelines across different markets.